3 min read

Making the Case: Fighting for a Worker's Right to Rebuild Her Life

Aaron Ferguson Law Sep 30, 2025 3:15:00 PM

Shannon Gilbertson hurt her back working at a funeral home. After the accident, she did what she was supposed to do: worked with a consultant to create a plan for getting back to work. The plan recognized her family needs and her goal to find a job with a different employer in the same field. Everyone signed it—Shannon, her consultant, and the insurance company.

But when it was time to follow through, the employer and insurance company changed their minds.

They offered her the same job she'd already quit due to family responsibilities, then threatened to cut off ALL her future workers' compensation benefits if she said no.

The insurance company was trying to ignore a signed plan just because it didn't suit them. We knew that letting this happen would hurt workers' rights across Minnesota.

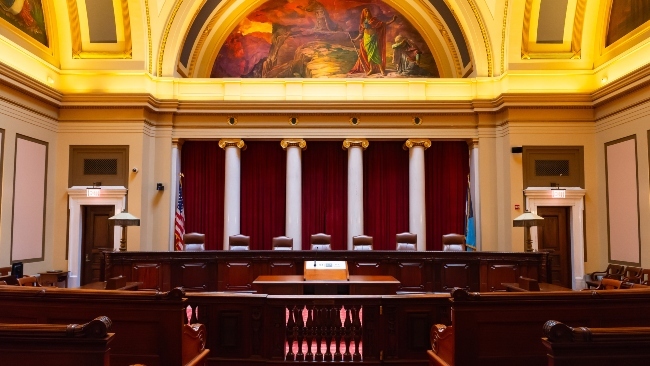

So we fought all the way to the Minnesota Supreme Court to establish one simple rule: When everyone agrees on a plan, insurance companies can't just ignore it later.

The Real Stakes: Her Entire Financial Future

In the courtroom, Aaron explained exactly what the insurance company was trying to do. This wasn't about eight weeks of benefits. This was about Shannon's whole financial future.

"If you were to determine that her light duty refusal was against the confines of [the statute], she would forfeit not only the temporary total disability benefits from that point (June 25, 2012), but up until her re-employment," Aaron told the justices.

But it went deeper than that. If the court sided with the employer’s insurer, she would lose all her future benefits too, including those for surgery the insurance company already approved.

The insurance company wanted to create a trap: Sign any plan they wanted, then force workers back to jobs that didn't work for their lives. If you refused, you'd lose everything.

Exposing Secret Coordination

The insurance company claimed they hadn't coordinated with the employer. But emails told a different story.

"There was an email actually sent June 6th from the adjuster [to] the employer," Aaron revealed. They were already talking about making a job offer to Shannon.

The timing mattered: Shannon didn’t quit until June 14th. Aaron argued that “it’s extremely disingenuous for the insurance company to come here and act as though there was no conversation underway."

They planned the whole thing while pretending to follow the proper process. Worse yet, they never followed any of the rules about changing the plan or giving notice to the consultant whose job it was to help Shannon.

This audio has been edited to include select excerpts relevant to the topics discussed in this blog. To view the full proceedings, visit the Minnesota Supreme Court Oral Argument Video Page.

Fighting for Workers as Human Beings

The insurance company's approach showed they didn't understand what workers' compensation is really for. They wanted to treat injured workers like objects to plug back into jobs, no matter the human cost.

Aaron challenged this directly.

"An injured worker doesn't check themselves at the door and lose all their rights of humanity simply because we have a statutory scheme in place, right? We all have responsibilities towards our family."

The law already recognized this: "You can't then say, in order to get the benefit, you have to discard all of those things that make you a good worker." Shannon had family obligations that made the on-call parts of her old job impossible—the same obligations that made her quit before getting hurt.

"If you've got a situation in which an injured worker has to go pick up their child at daycare or they have to take care of a family member who's suffering with cancer or unfortunately had some other accident, you can't then say...in order to get the benefit, you have to discard all of those things," Aaron noted.

A Win That Protects All Workers

We won at the Minnesota Supreme Court. The Court ruled that "an offer to return to work with the same employer is not consistent with a plan that says the worker's goal is to return to work with a different employer."

This decision protects both workers and the system itself. It prevents insurance companies from using plans as traps—signing off on plans they never intended to honor, then cutting off benefits when workers stick to those plans.

Shannon's case shows what we fight for every day: not just immediate benefits, but your right to rebuild your life in a way that works for your family.

If you're being pressured to accept work that doesn't fit your life, or if an insurance company is threatening to cut your benefits for refusing a bad job offer, recognize what's happening: they're trying to force you out of the system.

You don't have to accept it. We'll expose their coordination, challenge their attempts to ignore agreements, and fight for every dollar you deserve—not just what's easy to get.