3 min read

Auto Insurance Coverage: Understanding the Declarations Page

Aaron Ferguson Law Feb 28, 2025 9:00:00 AM

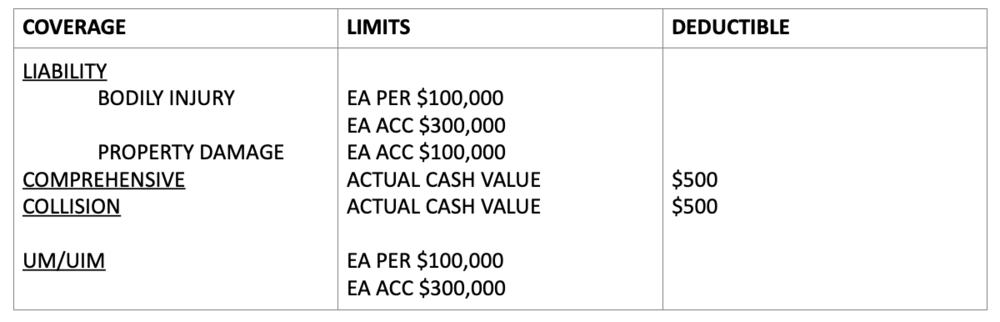

Insurance policies can be confusing. If you’ve looked at your auto insurance policy declarations page, you may see a jumble of numbers and abbreviations. For example, under the “Coverage” portion of the document you may see something like this:

Your declarations page (often called the "dec page") is a summary of your auto insurance policy, outlining your coverages, limits, and deductibles. It's typically the first page of your policy documents and serves as proof of insurance.

Let’s go through each one to decipher exactly what you're purchasing when you pay your monthly insurance premiums.

Essential Coverage Types Explained

Liability Coverage

Your liability coverage pays for injuries you cause to others in an accident. Liability coverage is applied for both bodily injuries (to other people) and property damage.

You’ll likely see two numbers to show the range of liability coverage on your policy. A typical policy showing "100/300" means that your policy will cover:

- $100,000 maximum payment per person injured

- $300,000 maximum payment per accident

While these limits may seem substantial, consider that a single serious injury can easily exceed $100,000 in medical bills alone, before even considering pain and suffering compensation. Property damage costs can also quickly exceed that amount, especially if multiple vehicles are involved. Learn more about liability coverage requirements.

Physical Damage Coverage

Comprehensive and collision coverage involves damages caused to the vehicle listed on the policy:

- Collision covers damages related to a car crash, regardless of who is at fault for the accident.

- Comprehensive covers things unrelated to a car crash, such as vehicle theft (including increasingly common catalytic converter theft), or damage caused by hail, fire, or vandalism. Damage caused by striking a deer in the road also falls under this portion of the policy.

Insurance policies use two different methods to determine payment amounts: actual cash value and replacement cost value:

- Actual cash value covers a vehicle up to its current value, accounting for deprecation. Depreciation is the loss of value since you purchased the car, based on mileage, wear and tear, and accident history. Actual cash value coverage is typically cheaper in premiums, but pays less on your claim.

- Replacement cost value covers the full cost for a vehicle with a similar make and model today, without accounting for depreciation. Replacement cost value coverage usually costs more in premiums, but pays better on your claim.

In the above example, the policy will pay for the “actual cash value” after the policyholder pays their $500 deductible. With modern vehicles containing expensive electronic systems and sensors, these coverages have become increasingly important.

Understanding UM/UIM Coverage

The next section deals with the UM/UIM portion of the policy. UM stands for Uninsured Motorist. Unfortunately, some people either cannot afford or choose not to pay for insurance coverage. If a driver with no insurance causes an accident, your insurance will step in and handle your bodily injury claim. Uninsured Motorist (UM) coverage provides:

- Medical expense coverage

- Lost wage compensation

- Pain and suffering damages

UM coverage typically offers the same limits as your liability coverage, but check your policy to confirm.

An Underinsured Motorist (UIM) is one who causes an accident but does not carry enough liability coverage on their own policy to cover all of your damages. UIM coverage is indispensable if you get seriously hurt in an accident. Minnesota's minimum requirements ($30,000 per person/$60,000 per accident) often fall short in serious accidents, particularly when:

- Your medical bills exceed their policy limits

- You need long-term care or rehabilitation

- Multiple people are injured in the same accident

What to Check After an Accident

Coverage Effective Dates

- Verify your policy was active when the accident occurred

- Check if any recent changes affect your coverage

Policy Limits

- Review all coverage limits

- Consider whether they're adequate for your situation

Deductibles

- Note applicable deductibles for collision/comprehensive claims

- Understand when deductibles apply

Listed Drivers

- Confirm all household drivers are listed

- Verify vehicle information is accurate

When to Seek Legal Help

Insurance claims involving serious injuries or disputed liability often require professional legal guidance. This is particularly important when dealing with uninsured or underinsured drivers, denied claims, or complex policy interpretations. An experienced attorney can help navigate these challenges and ensure you receive the full benefits you're entitled to under your policy.

If you were injured in an auto accident and you have questions about insurance coverage, please call Aaron Ferguson Law at 651-493-0426 to schedule a free consultation.

Get a Free Case Consultation